- Speak to a licensed sales agent!

- (800) 521-7873

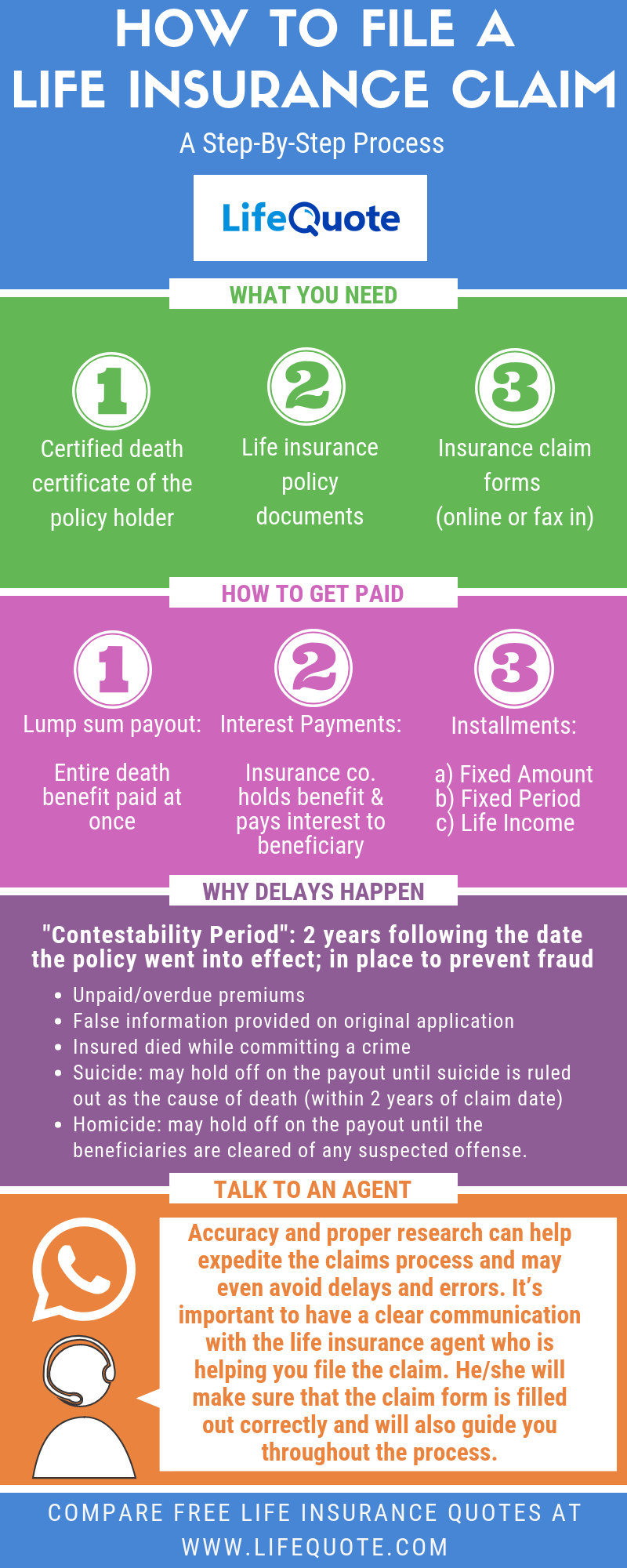

How to File a Life Insurance Claim: A Step by Step Process

To begin the life insurance claim process, it is recommended to contact the insurance carrier as soon as possible following the death of the policyholder. The claims representative will require some paperwork and important documents like death certificate and a copy of the life insurance policy to process the claim. This article will help you prepare for filing the life insurance claim

Amidst all the headaches and details you have to take care of when a loved one dies, the last thing you want to worry about is life insurance. No matter how organized (or not) the insured family member was, you need an efficient, timely way to make sure your family receives their life insurance benefits. You don’t want it to fall through the cracks…however, you don’t have to figure it out on your own. Here’s how to file a life insurance claim so you can get the payout you are entitled to.

What Do You Need?

1) Death Certificate:

The very first thing that you should look for is the death certificate of the policyholder. The insurance company won’t take any action and won’t start the life insurance claim process without the proof that the insured has indeed passed. Track this down or get it from your funeral director ASAP…they’ll even provide you with several copies just in case.

2) The Life Insurance Policy:

This can be hard to look for if nobody knows where the insured kept all his policy documents. If you know the name of the insurance company, try calling them. They can help you locate the policy. If not, do a little digging. Search bank statements, e-mails, or tax returns for any indication that premiums were being paid. Search file cabinets, safes, or other places where important documents are usually kept. You can even talk to the deceased’s former employer to see if they have any info regarding a work-issued life insurance policy.

>> Read: How to Find the Life Insurance Policy of a Deceased Loved One?

3) The Insurance Claim Forms:

With both the death certificate and the policy information in hand, you can now fill out the necessary claim forms required by the insurance company. You can usually find them online, or have them mailed to you to fill out and fax in.

How to Get Paid?

Once approved, there are a couple of ways you, the beneficiary, can receive your life insurance payout. You’ll likely be presented with the following options:

1) Lump sum payout: Get the entire death benefit amount paid out at once, tax-free. If there are large funeral bills or other significant payments needing immediate attention, this is a good option for you. The payout might even come in the form of a draft account (similar to a checking account) where the death benefit resides for you to dip into at any time until the money is used up.

2) Interest payments: The insurance company holds the death benefit and pays interest to the beneficiary. This keeps the death benefit intact so that it can go to a secondary beneficiary upon your death. If you’re the primary beneficiary and you’ve got children who may have student loans one day, this is a great option for you.

3) Installments: Receive the death benefit in smaller chunks over time. This could be a great source of added income for you and your family for years to come. Insurance companies use different terms to define installment plans, so let’s clarify what they are.

a. Fixed Amount or Specific Income: Allows you to receive the death benefit in equal installments of an amount you decide until the money runs out.

b. Fixed Period, or Period Certain: Allows you to receive the death benefit over a guaranteed time period, divided equally across that time.

c. Life Income: creates an annuity that distributes regular payments to you for the remainder of your life, based on life expectancy.

What If There’s a Delay?

Delays are expected. They can happen for a couple of reasons. Most life insurance policies have what’s called a “contestability period,” usually 2 years following the date the policy went into effect. This is in place to prevent any fraudulent use of the insurance policy.

Reasons Why a Life Insurance Claim Might Be Delayed or Denied:

1) Unpaid/overdue premiums.

2) False information provided on the original life insurance application.

3) The insured died while committing a crime.

4) Suicide: Many policies have a clause stating they cannot pay the death benefit if the insured commits suicide. In the two years following the date of the claim, insurance companies may hold off on the payout until suicide is ruled out as the cause of death. After two years, they cannot deny your claim on the grounds of suicide.

5) Homicide: Before paying the death benefit on an insured individual who was murdered, the insurance company may hold off on the payout until the beneficiaries are cleared of any suspected offense.

Life insurance is meant to provide peace of mind to the policyholders and their loved ones. Life insurance claims don’t have to be a complicated thing. Accuracy and proper research can help expedite the claims process and may even avoid delays and errors. It’s also important to have a clear communication with the life insurance agent who is helping you file the claim. He will make sure that the claim form is filled out correctly and will also guide you throughout the process.

Have more questions related to life insurance and how it works? Visit our Life Insurance Blog.