Got questions to ask about term life insurance?

Of course you do – it’s not something most people look up just for fun. Our licensed insurance experts know all the term life insurance questions to ask you in order to identify the insurers and policies that will best meet your needs. That’s what most people don’t realize. It’s easy to get a fast, free quote online, but you get the best service when you talk to an agent. At LifeQuote, we offer expert guidance to help you find the answers to questions you may not have known to ask.

Still have questions to ask term life insurance agent(s)?

We’re always happy to help our clients. Call us at 1-800-521-7873 or email us at hello@lifequote.com.

Questions to Ask When Buying Term Life Insurance

From the medical exam to making your first payment, we know there are lots more term life questions to ask and answer. We’ve got you covered. Here are even more questions from clients just like you that we’ve answered in the past. We'll answer all of them below.

- Not sure if you're too old to get life insurance? We'll talk about two types of coverage best suited for seniors.

- Is life insurance tax deductible? In most cases, the IRS views your premium payments as a personal expense – but we’ll tell you about a few exceptions below.

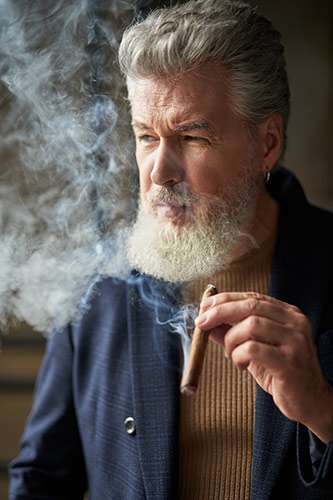

- Are you a cigar aficionado? Find out whether or not you're eligible for non-smoker life insurance rates.

- Can you get life insurance if you’ve had a heart attack? We’ll tell you what insurers look for if you have heart disease or have already had a heart attack.

- Do the kids need their own life insurance? We’ll show you solutions that do a better job of providing financial security for your family.

Am I too old to apply?

This is one of the most common term life insurance questions we get! It’s true that your age will affect how much you pay for life insurance coverage. It’s easy to think that you might “priced out” of getting a policy if you’re in your 70s or over. But that’s not the case, luckily. The older you are, the more likely it is that you want coverage that lasts the rest of your life – coverage that’s definitely going to pay out, in other words. There are two specific policy types that work the best for our senior clients:

- Guaranteed universal life. This policy is guaranteed to last through a certain age (you can choose this age, up to 121 years). This is an affordable policy because unlike other forms of universal life, it doesn’t build cash value. This means you’re not paying the administrative fees and extra premium associated with those cash value accounts. It’s the best of both worlds: affordability + lifelong coverage.

- Guaranteed issue. As the name implies, this type of policy is available to just about everyone, even those with health issues. These are essentially whole life policies with relatively small amounts of coverage, designed to cover final expenses. To apply, all you have to do is answer a brief health questionnaire with a few questions. If you have been diagnosed with a terminal illness or live in a nursing home, for example, you probably will not qualify. For more information on guaranteed issue, click or tap here.

Is my policy tax-deductible?

In most cases, no. We understand why this is one of the top questions to ask about term life insurance – who doesn’t want to reduce their tax liability? But the IRS sees life insurance as a personal expense, which means you can’t deduct your payments. That goes for both term life and permanent policies. Plus, paying for your policy with after-tax dollars ensures the death benefit paid out to your beneficiaries is tax-free. That’s the trade-off.

But there are a few exceptions that may apply to you if you answer “yes” to any of these term life insurance questions:

- Did you buy life insurance to satisfy a divorce decree? If so, your premiums are tax-deductible.

- Does a charity own the policy, even though you pay the premiums? If so, your premiums can be deducted as charitable gifts. This works because you are not the policy’s owner even though you pay the premiums. If you own the policy and pay the premiums – even if the charity is your beneficiary – this strategy doesn’t work and you cannot deduct your premiums. If you’re interested in setting something like this up properly, give us a call. We can help ensure everything is set up correctly based on your goals for both the death benefit and for your tax liability.

The best approach? This is one of those times when your term life insurance questions should be directed to your tax professional. If you already own a policy, ask your tax pro for help based on your specific situation. If you don’t own a policy yet, contact us and tell us what you’re looking to achieve. We’ll help find the right planning strategies for you.

Still have questions to ask term life insurance agent(s)? Get in touch! Call us at 1-800-521-7873 or email us at hello@lifequote.com.

Can I get life insurance if I smoke?

When it comes to term life insurance questions to ask, this is an important one. And the short answer is yes, you can.

Life insurance carriers want to know what you smoke (cigarettes, cigars, marijuana, smokeless tobacco, etc.) and how often you smoke. Based on your answers, they’ll assign you a rate class. That rate class determines what you’ll pay for coverage.

Most insurers require you to have been a non-smoker for one year in order to qualify for non-smoker rates. There are a few exceptions, however. If you only smoke the occasional cigar, you may still qualify for a non-smoker rate. Similarly, if you only use smokeless tobacco, you may also qualify for a special rate that’s less expensive than if you smoke cigarettes.

Each provider sets their own underwriting guidelines and rates, so it’s worth talking to an agent before you apply. Our licensed experts already know which carriers are likely to be more lenient for the occasional recreational marijuana use, for example.

Of questions to ask when buying term life insurance, this is one of the most important to answer honestly. Keep in mind that the results of your medical exam - required for the most affordable policies – will reveal the truth about whether you smoke.

The most important take-away? You can get coverage if you’re a smoker. Be up-front with your agent about what you smoke and how much, and we can advise you on the best carrier and policy for your situation.

Can I get life insurance if I had a heart attack?

That depends. As with so many questions to ask about term life insurance, the answer depends on your unique situation. We’ll give you some basic information here, but the best thing you can do is get in touch so we can go over the details of your health history. Once we have a fuller picture of your health, we can discuss how the insurers will likely evaluate you in terms of risk.

In general, an insurer is going to want to know what treatment you underwent after your heart attack. Of questions to ask when buying term life insurance, they will want to know: did you have a coronary artery bypass graft? Did you have an angioplasty or stent put in? If your treatment happened within the last six months, an insurer will probably ask you to wait another six months before applying. If everything goes well, they’ll then want to see test results and follow-up plans. If they like what they see, they may offer coverage – but at a much higher rate than someone who hasn’t had heart disease or a heart attack.

The best thing to do? Give us a call so we can evaluate your situation and help you find the carrier most likely to offer you coverage.

Still have questions to ask term life insurance agent(s)? Shoot us a quick email or give us a ring at 1-800-521-7873.

Should I buy a life Insurance policy for my child?

This is one of the most common term life insurance questions to ask! But in most cases, we don’t recommend this. The whole point of life insurance is to protect the financial contributions of the adult family members. Your children probably don’t make financial contributions just yet, and don’t need coverage as a result. If you’re looking for ways to provide for your child’s future, there are better solutions available:

- Increase coverage for yourself. As an adult, you have bills and financial responsibilities you’re your child doesn’t. You’re the one who needs as much coverage as possible to cover those obligations until your loved ones can do so themselves.

- Set up a trust. If you want to have more control over who has access to the death benefit and when, we can help you set up a life insurance trust for your child’s benefit.

- Look into a cash value policy. If you’re looking for a way to help pay for your child’s education, cash value life insurance can do that – if you buy it at the right time. If you buy a policy a couple years before your child will need a college fund, your policy won’t have enough time to grow and compound into a sum that would be truly helpful. On the other hand, if you buy yourself a policy when your child is young and the policy matures for 15+ years, you could have a sizeable cash value account to help pay those tuition expenses.