- Speak to a licensed sales agent!

- (800) 521-7873

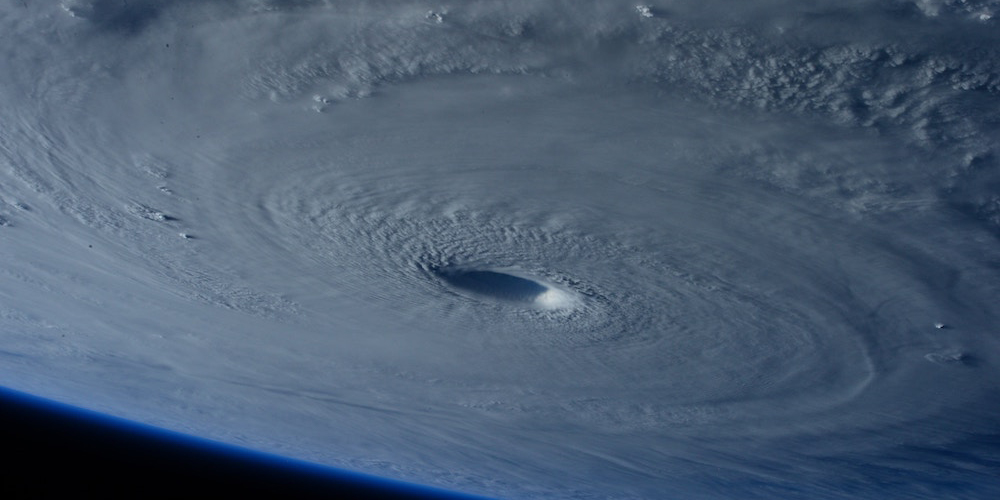

Hurricane Michael 2018: Add Life Insurance to Your Hurricane Preparedness Checklist

As reported by The Weather Channel News, Hurricane Michael barrels down on the Gulf coast of Florida this afternoon. The surrounding cities are now more motivated to make sure their families are hurricane-ready, as the season continues through November.

The Bryan Norcross’s of the world in the meteorological sphere have been extremely helpful in helping citizens make early preparations. In fact, we highly recommend people especially those living in hurricane-prone areas to have their preparedness checklists completed by the start of the hurricane season, whether or not a storm is imminent in their area. Being prepared prevents the last-minute panic we tend to see as people gather supplies, important documents, and hunker down or evacuate.

Most people are aware that part of this early preparedness involves the subject of insurance, but most are mainly concerned with covering their homes, their cars, or their businesses. However, many forget another important thing to cover in preparation for natural disasters: their own lives.

Life insurance should be an important piece of the puzzle as you get prepared for hurricane season. It seems morbid, but think about it: you want your family to be as safe as possible, so in the worst-case scenario (where something happens to you), wouldn’t you want to know they would be provided for? Of course, you would.

However, this isn’t like a last-minute grocery store run for cases of water and canned goods. Life insurance is something you don’t want to have to think about in the days immediately preceding a major storm like Hurricane Michael. To be ready when the time comes, get prepared with life insurance now so that your life insurance policy can get stored in plastic bags along with your other important documents as you prepare in those critical days.

You might be thinking…

1) “Won’t it be too late? Getting life insurance could take weeks!”

Well, that’s not necessarily true. Plenty of insurance companies offer life insurance products that don’t require the hassle and time of a medical exam. All it would take is a few simple health questions and, depending on if you qualify, you could receive a policy in a matter of days.

>>Learn more: No exam life insurance

2) But isn’t life insurance really expensive?

Again, not necessarily. Term life insurance is an affordable option for many families, especially if you’re in good health. Moreover, the younger you are, the cheaper your rates will be. Below are some sample rates with different life insurance companies at different ages, which you can always get quoted for free if you’re still not sure.

Sample life insurance quotes for Men, $250,000 face value, 20-year term, Florida, Healthy Non-Smoker

| Insurance Company | 25 | 35 | 40 | 45 | 50 |

|---|---|---|---|---|---|

| AIG | $13.32 | $13.75 | $19.38 | $29.32 | $42.73 |

| Banner | $12.90 | $13.67 | $19.01 | $27.95 | $40.85 |

| Haven Life | $16.91 | $18.01 | $24.25 | $34.53 | $51.93 |

| Lincoln National | $18.82 | $20.57 | $28.23 | $43.32 | $65.85 |

| Mutual of Omaha | $13.78 | $14.88 | $20.13 | $30.63 | $46.16 |

| Prudential | $19.03 | $20.78 | $24.50 | $29.97 | $45.50 |

| Transamerica | $14.41 | $19.57 | $26.66 | $36.34 | $53.11 |

Sample life insurance quotes for Women, $250,000 face value, 20-year term, Florida, Healthy Non-Smoker

| Insurance Company | 25 | 35 | 40 | 45 | 50 |

|---|---|---|---|---|---|

| AIG | $11.59 | $13.32 | $18.51 | $25.00 | $35.59 |

| Banner | $11.25 | $12.04 | $15.26 | $22.57 | $31.56 |

| Haven Life | $13.83 | $16.03 | $20.22 | $27.26 | $39.15 |

| Lincoln National | $16.42 | $17.29 | $23.20 | $32.60 | $46.60 |

| Mutual of Omaha | $12.25 | $13.78 | $17.06 | $24.72 | $35.66 |

| Prudential | $16.41 | $17.72 | $22.53 | $29.09 | $40.03 |

| Transamerica | $11.83 | $17.20 | $22.79 | $29.89 | $43.00 |

Note: All these rates are for informational purposes only. They are subject to change and must be qualified for.

3) Why go through the hassle, just for a hurricane?

Life insurance protection goes well beyond hurricane preparedness. In all likelihood, if you’ve prepared well and taken proper safety precautions, you will survive a hurricane. But it doesn’t hurt to prepare for the worst. This is especially true since, after the storm passes, you still have life insurance coverage that can last and provide your family with financial resources whenever your time does come. Other reasons you may one day reap the benefits of life insurance include:

- To replace lost income in a dual or single-income household

- To cover final expenses, such as funeral costs and outstanding debts

- To pay off a mortgage

- To provide for a business or business partner

- To cover the cost of future education for your children

- To cover alimony or child support in case of a divorce

- To provide continued support for an aging/special needs family member

- Estate planning

- Charitable giving

>> Read: Why do you need life insurance?

In Summary

The benefits of life insurance vastly outweigh the costs. Why not make it part of your ongoing hurricane and natural disaster preparedness? Hopefully, you won’t need to use it after a hurricane, but you’ll at least have the peace of mind that should anything happen, your family is protected…in more ways than one.