- Speak to a licensed sales agent!

- (800) 521-7873

Affordable Life Insurance for Diabetics Type 1 – Is It Possible?

Finding affordable life insurance for diabetics type 1 can often be challenging. Many different variables will be considered in the application process, and anything that may statistically decrease your life expectancy may narrow down your available options.

Fortunately, there are still many ways that people with type 1 diabetes can find a reasonable life insurance policy. In this article, we will briefly discuss strategies for finding affordable life insurance, and which types of policies may work best for you.

The Impact of Type 1 Diabetes on Life Insurance

From a life insurance perspective, type 1 Diabetes is considered to carry a higher risk than type 2 because it usually manifests earlier in life and can create more health problems later on. While it is possible to obtain life insurance with type 1 diabetes, the underwriting, however, is more difficult. It is most possible that you will be rated in a lower health class which means that you will be paying higher premiums or that your life insurance coverage will be limited.

Difference between Type 1 and Type 2 Diabetes

Once known as “juvenile diabetes”, Type 1 is usually found in children and young adults. According to the American Diabetes Association, it is a condition in which the body does not produce insulin. Insulin is a hormone needed to get glucose from the bloodstreams into the cells of the body. This helps in producing energy which is needed to perform daily life activities.

Type 2 diabetes manifests later in life and is caused when the body cannot produce enough insulin. It is primarily caused by a combination of genetics and lifestyle factors. Problems like obesity, stress and excessive consumption of sugar and starch are the primary causes of Type 2 diabetes.

How to Compare Different Life Insurance Policies?

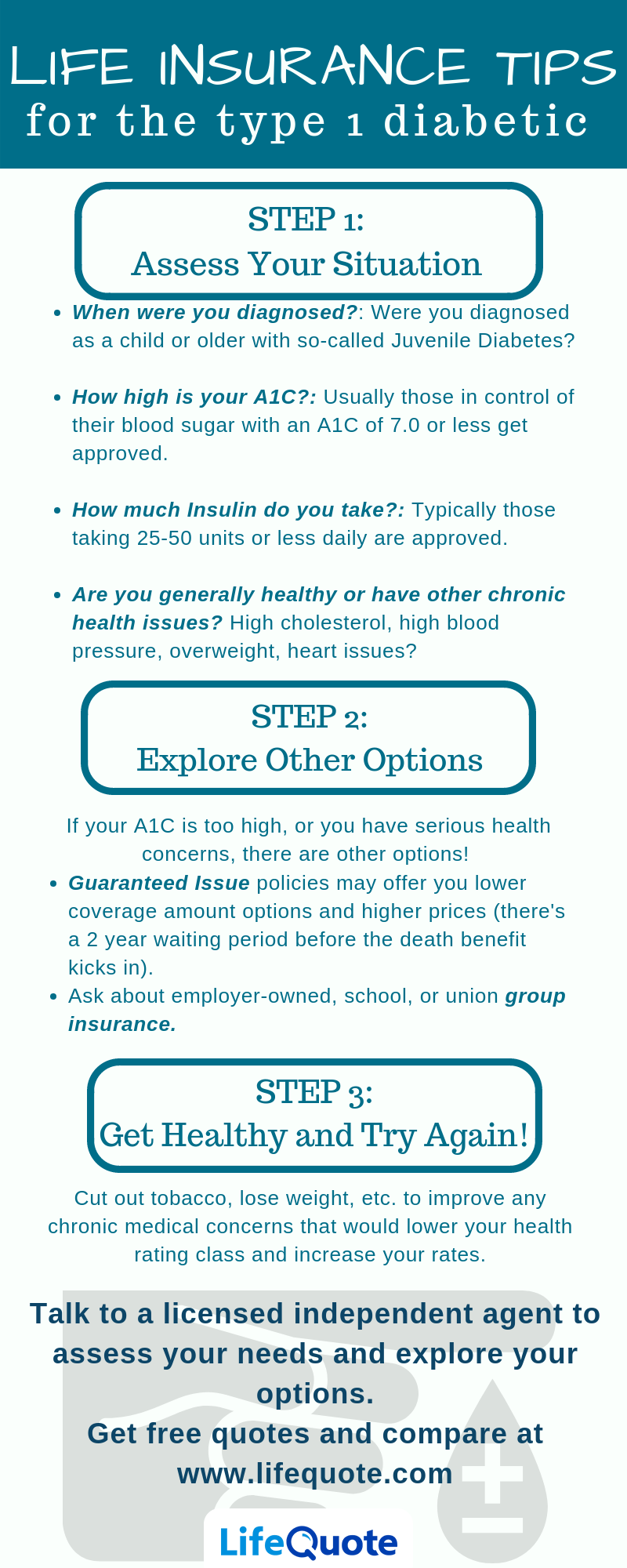

If you are someone who has type 1 (insulin-dependent) diabetes, there are a few things you can do to make the search for affordable life insurance a little bit easier.

- Keep an eye out for policies that do not require a medical exam or questionnaire

- Work with an independent life insurance agency or website that will allow you to compare multiple policies at once. This is really important. Rate comparison from several different companies gives you an idea of which company offers the best rate and will it be the best to cover all your needs?

- Research companies that specifically target individuals with type 1 diabetes

- Check to see if your employer already provides life insurance

There are two primary types of life insurance. Term life insurance is usually more affordable and will provide you with coverage for a specific amount of time. Permanent life insurance will last the entire length of your life. Often, the policies that are best for individuals with type 1 diabetes will be a unique combination of these policies (permanent policies with delayed death benefits).

No Exam Life Insurance Coverage

Any life insurance policy that advertises itself as a “no exam” life insurance policy will likely be something that people with diabetes should consider applying for. Though these policies may not have the same level of total death benefits as policies targeting other groups of people, you will still be in a position where you can provide your loved ones with significantly more money than you initially paid in.

One of the best things about No Exam Life Insurance policies is that—despite the fact they target higher risk individuals—they are usually still quite affordable on a monthly basis. Depending on the type and amount of coverage you are hoping to receive, you may be able to gain lasting coverage for less than $1 per day.

The Best Life Insurance for Diabetics Type 1

To qualify for the most affordable life insurance for diabetics type 1, you should do all that you can to manage the aspects of your health that you can control. This means doing things such as watching your weight, taking your medicine, and avoiding smoking will put you in a much better position to secure the best rates (and also prolong your life expectancy).

Currently, there are hundreds of different life insurance providers across the United States. Each of these providers will have various pros and cons associated with them. When comparing your available options, you should consider the size of the death benefit, any relevant terms, and also consider the monthly premium you will be expected to pay.

Though you should definitely account for a wide range of factors before making any lasting commitments, these life insurance companies are often considered to be among the best for individuals with type 1 diabetes:

Conclusion

Having a pre-existing condition such as diabetes can undeniably be a bit of an obstacle when trying to purchase life insurance. But that doesn’t mean you are not without options. Take the time to compare the different options you have available and understand the underwriting process. Then you will be in a much better position to find an affordable life insurance policy that can work for you.

If you are looking for affordable life insurance for diabetics type 1, then give us a call today at (800) 521-7873. Our life insurance professionals will definitely help you search a policy that best meets your needs. Meanwhile, you can also ask for free life insurance quotes to give you an idea of monthly payments that you will be making after getting a life insurance policy.