- Speak to a licensed sales agent!

- (800) 521-7873

Life Insurance Beneficiary Designation-Make a Smart Decision

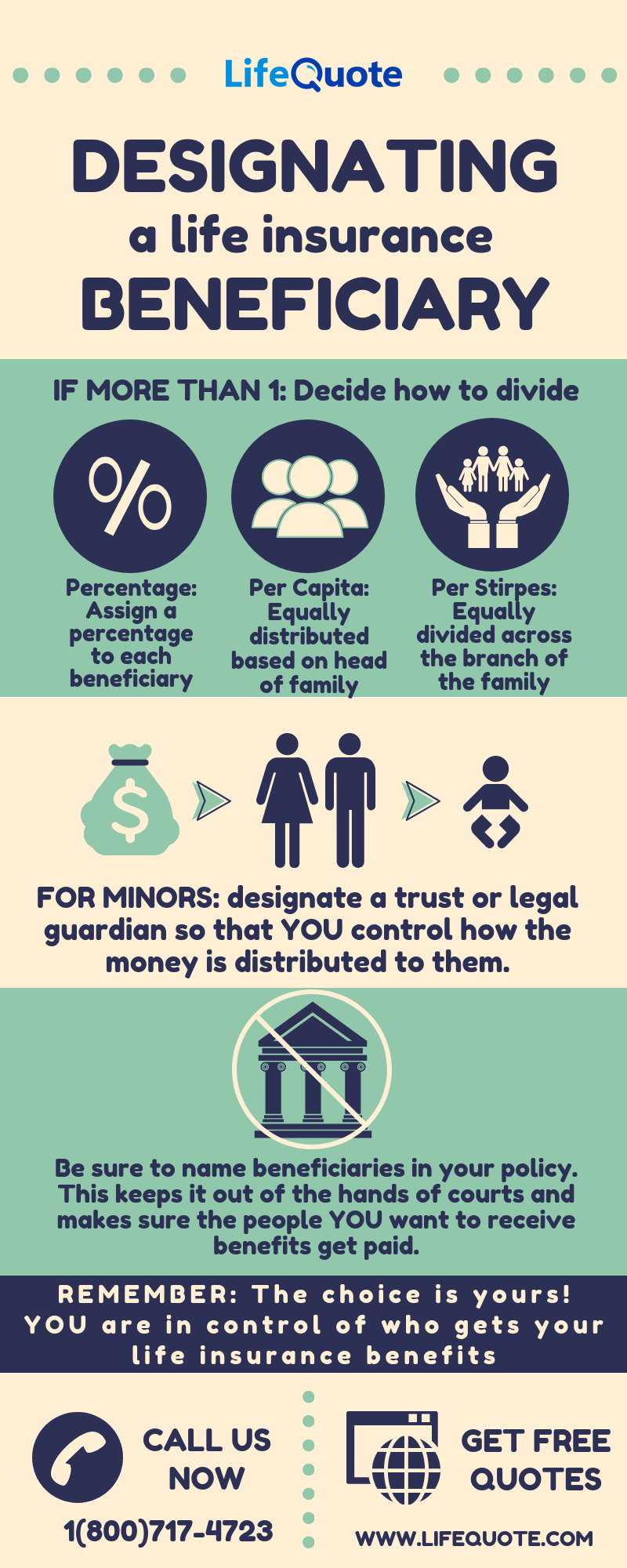

Designation of a life insurance beneficiary is one of the few decisions in the rules-driven insurance application and approval process that is completely under your control. Your beneficiary choice is solely at your discretion, unfettered by any restrictions from the insurer. While most policyholders generally purchase life insurance to fulfill a financial responsibility and the desire to protect loved ones, the decision of whom to leave the money is entirely in their hands.

The Freedom of Choosing A Beneficiary

- You don’t have to choose only one; you’ll have the option of designating multiple beneficiaries.

- A beneficiary can be a person, charity, business or trust. The person can be a relative, a friend, a lover, or a business partner… the sky’s the limit.

- You can select how you want the money divided… by the branch of the family, or by the head of the family. It’s technically called Per Stirpes or Per Capita; more details on that below.

- The Primary Beneficiary is the first-in-line to receive the insurance payout upon your death, but you can also pick a back-up—a secondary or Contingent Beneficiary as the second-in-line to get paid if the primary were to pre-decease you.

- Moreover, the last bit of freedom you enjoy in the life insurance beneficiary designation process is that you can easily change those people anytime you want, due to a change of heart or a change in your marital status.

- Switching that policy from an ex-spouse as the beneficiary to a new spouse is as simple as filling out a change of beneficiary form you download from the insurance company’s website.

- However, sometimes after divorce proceedings, a court can order that you maintain a policy enforce for the former spouse to cover alimony or child support responsibilities but your attorney can give you advice in this area.

- You can purchase another policy to benefit a new spouse and new children.

>>Read: Life Insurance Beneficiary Rules for Spouse

Beneficiary Designation Rules On Minors

Although your heart might be in the right place in wanting to name a minor child, it is the only restriction insurers impose on life insurance beneficiary designations. Some companies will not allow you to name them in the policy directly.

- In order to name that minor dependent, you will need to designate a trust or legal guardian as the beneficiary to receive the death benefit payout.

- Using the Uniform Transfers to Minors Act, that custodian will be able to receive and distribute the proceeds to the child.

- The advantage of naming a ‘Trust’ as beneficiary is that it will allow you to control how you want those proceeds distributed to the child and at what ages. You can even choose to distribute the money incrementally for specific expenses, instead of giving it as a lump sum to an 18 or 21-year-old who is not mature enough to handle a big chunk of money at that age.

Not Choosing a Life Insurance Beneficiary Could Cost Your Heirs

If you don’t have a beneficiary designated to receive your life insurance proceeds, your estate automatically becomes the beneficiary upon your death. Estate planners do not recommend this as a general rule for tax reasons, but also because your heirs will have to wait out the tedious probate process of settling your debts, and likely lose a chunk of the payout to creditors. That is why financial experts caution you to choose a person(s) as named beneficiaries in a policy and keep insurance proceeds out of the hands of the courts.

Provide Names And Details Of Your Life Insurance Beneficiary Designation

Listing “husband,” “wife” or “spouse” as your beneficiary is not going to cut it. This is a legal contract between you and the insurer that the carrier must honor by paying the right person after your death. The life insurance beneficiary designation in your policy even supersedes your Last Will and Testament. Avoid future court fights between an Ex and a current spouse by naming beneficiary names in your life insurance designation form. In addition to the person’s contact information, you must also list their DOB and Social Security Number.

More Than One Beneficiary: More Than One Way to Distribute The Money

Distribution methods you can specify in your policy to specify how you want to divide the death benefit among more than one beneficiary:

- By Percentages: Instead of naming a dollar amount per beneficiary, you assign each beneficiary a specific percentage. For example, each of your three children would receive 33.3% of the payout. Another example is that your spouse would get 50% of the money, with 25% going to each of your two kids.

- Per Capita: The Latin phrase means By Person. The money will be equitably distributed based on the head of the family. That way the surviving children of any of your beneficiaries that pre-decease you, will receive equal parts of the money.

- Per Stirpes: Translated from the Latin, it means By Branch. With this distribution method, the death benefit is divided equally across the branch of the family. For example, if your children die before you, their children (your grandkids) would be next in line to receive equal portions of the money. These latter two options keep it all in the family through the next generation.

The most important thing to remember in this whole explanation of how and why to designate a life insurance beneficiary is that you have power and control over your choices. However, don’t take it for granted.

Other Important Points to Remember:

- It is easy to change the beneficiaries anytime you wish by simply requesting a Change of Beneficiary Form from your insurance company.

- Keep your choices updated based on death, divorce, or just a change of heart.

- Also, let the people you have chosen know you picked them. It is recommended that you provide them with a copy of your policy or at the very least a policy number, name, and contact number of the insurance company.

- The insurance carrier will not automatically issue a death benefit check when you pass unless the beneficiaries go through the formal process of claiming the money.

- They will need to fill out the insurer’s Claim Form from the company’s website, or a paper form can be requested.

- A Certified Copy of the Death Certificate, obtained from the funeral home.

- A policy number, the actual policy, or a copy

You are investing good money to protect the future of the people to whom you will leave this financial legacy. Make sure they are prepared with the knowledge and the information they will need to someday truly benefit from this gesture of love.

Need help? Contact your insurance professional today to discuss your specific needs.