- Speak to a licensed sales agent!

- (800) 521-7873

Life Insurance and Types of Life Insurance: Term vs. Permanent

When it comes to life insurance and types of life insurance, there’s one question we get all the time: should I buy term or permanent? Let’s take a look.

All types of life insurance plans serve the same purpose: to pay a death benefit so your loved ones are taken care of if something happens to you. But some policies have added benefits that turn a standard policy into something more like a savings tool.

There are two main types of life insurance plans. The most common (and most affordable) type is term life insurance. Before making any significant decisions, it’s important to understand the differences between these two categories.

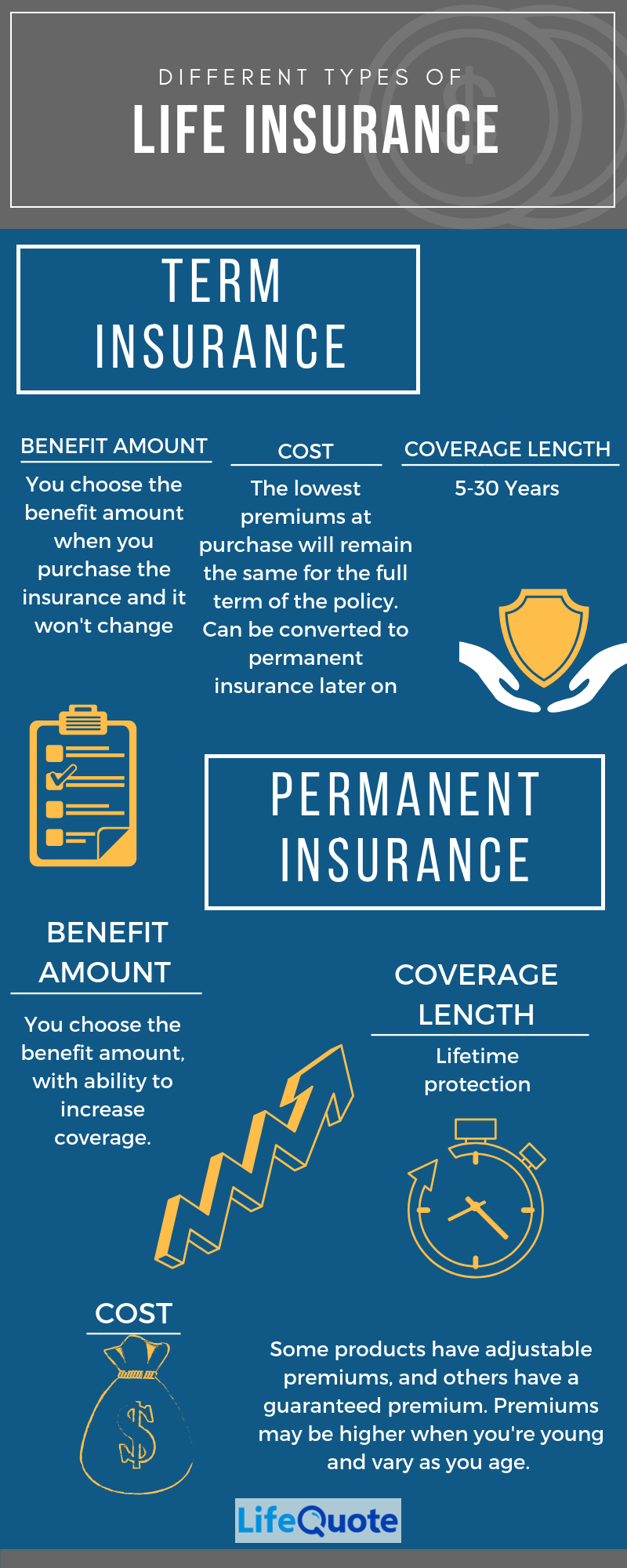

Types of Life Coverage: Term

Of all life insurance and types of life insurance, term is the most popular. As a policyholder, you pay a monthly premium. In exchange, the insurance company will pay your beneficiaries a predetermined amount of money in the event of your death during the policy’s term.

Term life provides coverage for a finite number of years – depending on the carrier, for as little as one year and as long as 40 years. If you outlive your term, you’re no longer eligible for benefits. Before the term ends, however, you usually have the option to renew your policy and continue coverage.

Many of our clients look into types of term life insurance because it’s the most affordable way to protect their family from financial distress. Depending on your age, health, and lifestyle, you may be able to qualify for policies that cost less than $20 per month.

Confused about the different types of life insurance? Let us help – it’s why we’re here! Call us at (800) 521-7873 and let us help you pick a policy that’s right for your needs and budget!

Types of Term Life Insurance

There are several types of term life insurance:

- Standard: Select a term length and coverage amount – that’s all there is to it. Your payments are locked in and will never increase or decrease throughout the term.

- No exam: No medical exam is required to apply; instead, you’ll have to answer questions about your medical history, family medical history, and lifestyle.

- Return of premium: For a higher payment, you can have all your premiums returned to you if you’re still alive at the end of your term.

- Mortgage protection: This type of policy names your mortgage provider as your beneficiary. The amount of coverage decreases over time as you pay down the mortgage.

- Annual renewable: This short-term coverage renews every year, although as you get older, your payments will go up, too.

Now, let’s move on from types of term life insurance to coverage that lasts a lifetime.

Types of Life Coverage: Permanent

In the world of life insurance and types of life insurance, permanent policies offer guaranteed coverage because there is no term to outlive. Unlike a term policy, a permanent policy offers lifelong coverage. That’s why they’re more expensive than their term-limited counterparts. Many people prefer permanent policies because once you’ve qualified, you never have to worry about requalifying in the future.

Additionally, permanent policies include a cash value account. Part of your premium payment is diverted into this account, where it grows and earns tax-deferred interest over time. If you want to borrow from it in the future, you can. Some of our clients let their cash value grow for years – or even decades – and then use it as supplemental retirement income later in life.

Some of these types of life coverage let you tie your interest gains to a stock index for the chance to earn more than a flat interest rate. But there’s a trade-off: these policies also have administrative fees, plus the tax liability on your interest gains.

Just like with term policies, there are several types of permanent coverage with very different purposes. Let’s look at the most popular: types of whole life insurance.

Need to talk to a real person? We’re here to help! Call us at (800) 521-7873 and let us help you pick a policy that’s right for your needs and budget!

Types of Whole Life Insurance

Whole life is the most popular type of permanent coverage – it’s also the least complicated. If you’re looking for something simple that will cover you until you pass away, this is your best bet. As long as you stay current with your payments, it will never expire.

Types of whole life insurance vary widely in price. Some simple plans keep the cost lower by offering small amounts of coverage, only intended to cover burial expenses. Other plans offer higher face values, but cost significantly more. This is because of their cash value component – your payments are funding the policy itself plus your cash value account.

While they’re not the most affordable policies out there, some of our clients prefer these types of whole life insurance because they function like a savings or investment vehicle. You can invest additional money in your policy over and above your required premium payments. The more money you put in, the more gets diverted into your cash value account with tax-deferred growth. We have clients who use this option once they’ve maxed out their available retirement plan contributions.

So what types of whole life insurance are there?

- Simplified issue whole life. Coverage with no medical exam required – but you will have to answer questions about your medical history and lifestyle.

- Guaranteed issue whole life. Coverage with no medical exam that pays a modest death benefit (up to about $25,000) intended to cover funeral and final medical expenses; almost all applicants qualify.

- Joint whole life. Coverage for two people; your policy can pay out either after one spouse dies or after the second spouse dies.

Need more guidance with whole life insurance and types of life insurance? Call us at (800) 521-7873 and let us help you assess your needs to find the right policy!

Other Types of Permanent Coverage

Unlike types of whole life insurance, two additional policies offer the potential for you to grow your cash value beyond a flat interest rate.

Universal life policies let you adjust your premium payments and the policy’s death benefit amount. For example, if you want to decrease your payments, the insurer will pull the difference from your policy’s cash value. There are several different types of universal life, the most popular being indexed universal life (IUL). With IUL, the interest rate of your cash value account is tied to the gains or losses of a stock index, like the S&P 500. When the index rises, you earn more interest. When the index loses value, you earn a flat, low rate of interest.

Variable life policies have cash value, too, but will cost significantly more than term life and whole life policies. These policies let you invest your cash value in funds selected by your insurer. The upside? If that fund does well, you grow your cash value faster. But if it doesn’t, you’re not guaranteed a return at all. For this reason, we rarely recommend variable life policies.

Want some personalized advice? We get it – that’s why we studied so hard to become licensed agents! Call us at (800) 521-7873 and let us help you sort it all out.

Which Type Is Right for You?

We can help you figure it out! There is no single insurance strategy that works for everyone. The right policy for you and your family will depend on a variety of different factors:

- Want low-monthly premiums while still establishing a sense of financial security? Consider term life insurance coverage.

- Want guaranteed coverage you can’t outlive and can afford higher premiums? Consider permanent coverage.

This page just scratches the surface of information we have to share with you. If you give us a call, we can get more familiar with your financial situation and make targeted recommendations just for you.

Next Steps

Check out our insurance needs calculator here – it’ll help you figure out how much coverage you need. If you need help or have questions, our licensed insurance agents are always happy to help.

Want to talk to someone? Our licensed agents are here for you! Call us at (800) 521-7873 and let us answer all your questions.