- Speak to a licensed sales agent!

- (800) 521-7873

Choosing the Right Life Insurance Company

Why Choosing the Right Insurance Company Is So Important?

How to choose the right insurance company? That’s one of the most common questions we receive from our clients.

With so many Insurance companies selling life insurance policies, the decision to go for the right one is never easy. It’s not like buying a pair of shoes that you can return back if you don’t find them comfortable, it’s an important life-changing financial decision.

This company that you will choose is going to be with you for the next couples of decades and you will be investing potentially hundreds of thousands of dollars. Therefore it should definitely serve the prime purpose for which you contacted the company on the first hand and that is your family’s financial protection.

To be honest, most large, top-rated life insurance companies sell the same policies i.e. term, whole or permanent. Yes, there are differences in rate classifications and premiums but that also depends on other factors such as your age, health, and lifestyle etc. So what you need to do is to find a company that works best for you in terms of budget and protection.

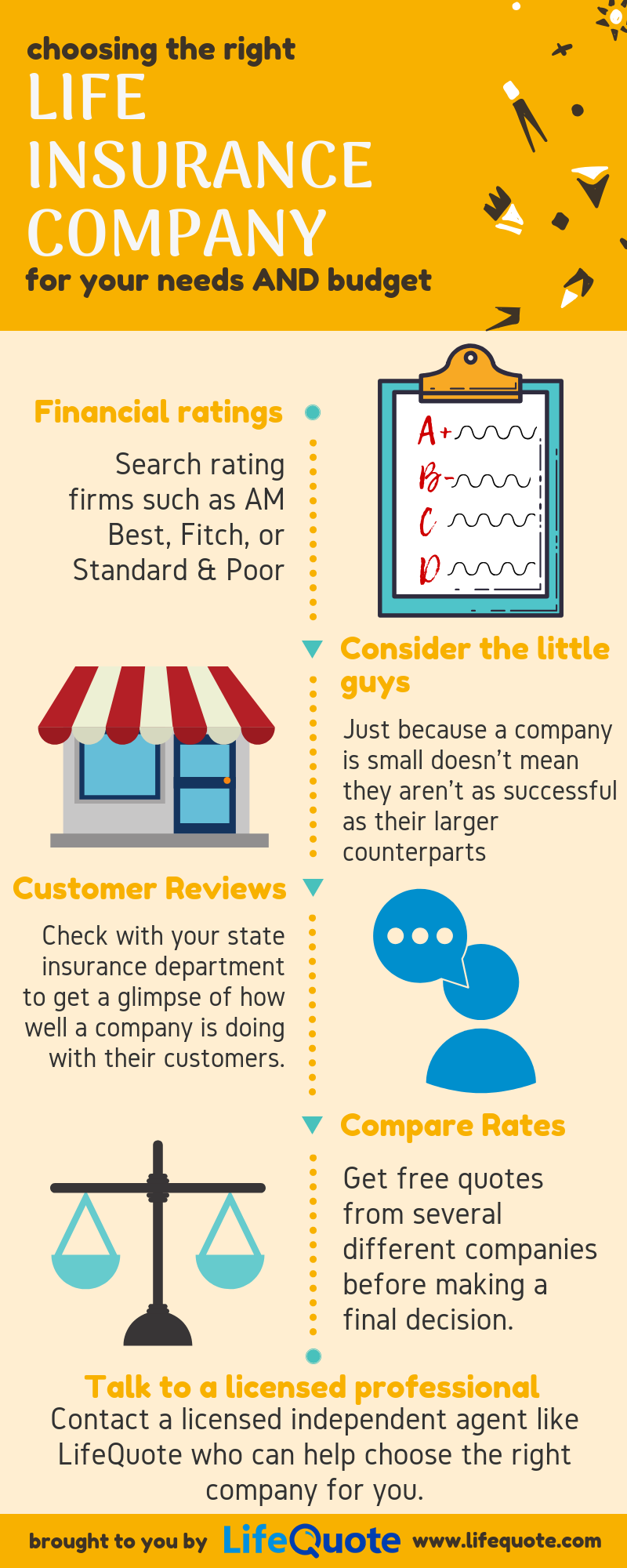

Let us give you some tips that will help you choose the right insurance company:

Check Out Company’s Financial Ratings:

A life insurance company with a strong financial background gives you a peace of mind that your beneficiaries will be taken care of whether you pass away in 5 years or 40.

There are many independent rating firms like A.M. Best, Fitch, Standard & Poor’s and Moody’s who rate these companies based on their financial performance. Don’t get yourself confused by different grades found in different agencies. They all have their own rating system. For e.g AAA is the top rating at Moody’s, but A++ is the best ranking at A.M. Best.

Don’t Run Behind Large Companies Only:

When looking for the right insurance company, we usually go for a company that has been in business for decades. The reason is that a company that has been doing business that long is more capable of understanding the complexities of the insurance business.

Managing risk, growing assets and a history of meeting long-term financial obligations, all these qualities make up a good organization. But that does not mean that only large companies have been successful.

There are many small-to-medium-sized life insurance companies that have been in business for a long time and have a solid historical record of meeting financial obligations just like their larger counterparts.

Look for Customer Reviews:

Checking in with your state insurance department will give you a nice glimpse of how well your insurance company is doing with their customers. This department keeps track of the complaints filed by the customers. These complaints may include disputes over claims, sales misrepresentations. policy cancellations etc. You can also visit the National Association of Insurance Commissioners website for more information on a particular company like their licensing and financial information and complaints filed.

Look Who Offers The Best Rates:

This is one of the important things that you look for when choosing a life insurance company. Every company has different guidelines for underwriting policies. If you get turned down by one or got rates that are quite heavy on your wallet, then you may try luck with another company. That’s why we recommend comparing life insurance quotes from several companies before you make your final decision.

Keep in mind that you cannot get the same policy cheaper if you buy directly from the carrier. Commission costs are built into the premiums so the Protective policy you got a quote for through an independent broker like LifeQuote will be the same if you go through Protective themselves.

Talk to an Insurance Professional:

Buying life insurance through agents and brokers is a wise choice. Don’t worry, you won’t be charged an extra fee as all the commissions are tied in the premiums that are being paid by the life insurance company itself. The customer pays the same amount of premium whether they go through a broker or buy directly from a company.

As there is no saving in buying directly, therefore, we recommend buying life insurance through professional brokers. Deciding how much and what kind of insurance to buy are complicated yet important financial decisions. One small mistake can make you lose thousands of dollars!

After conducting a thorough insurance needs analysis, a qualified life insurance agent will provide you with policy recommendations that are not only based on just company rating but also on personal knowledge and experience in dealing with these companies. In short, they will strive to get you the best rates possible from the best life insurance companies out there.