- Speak to a licensed sales agent!

- (800) 521-7873

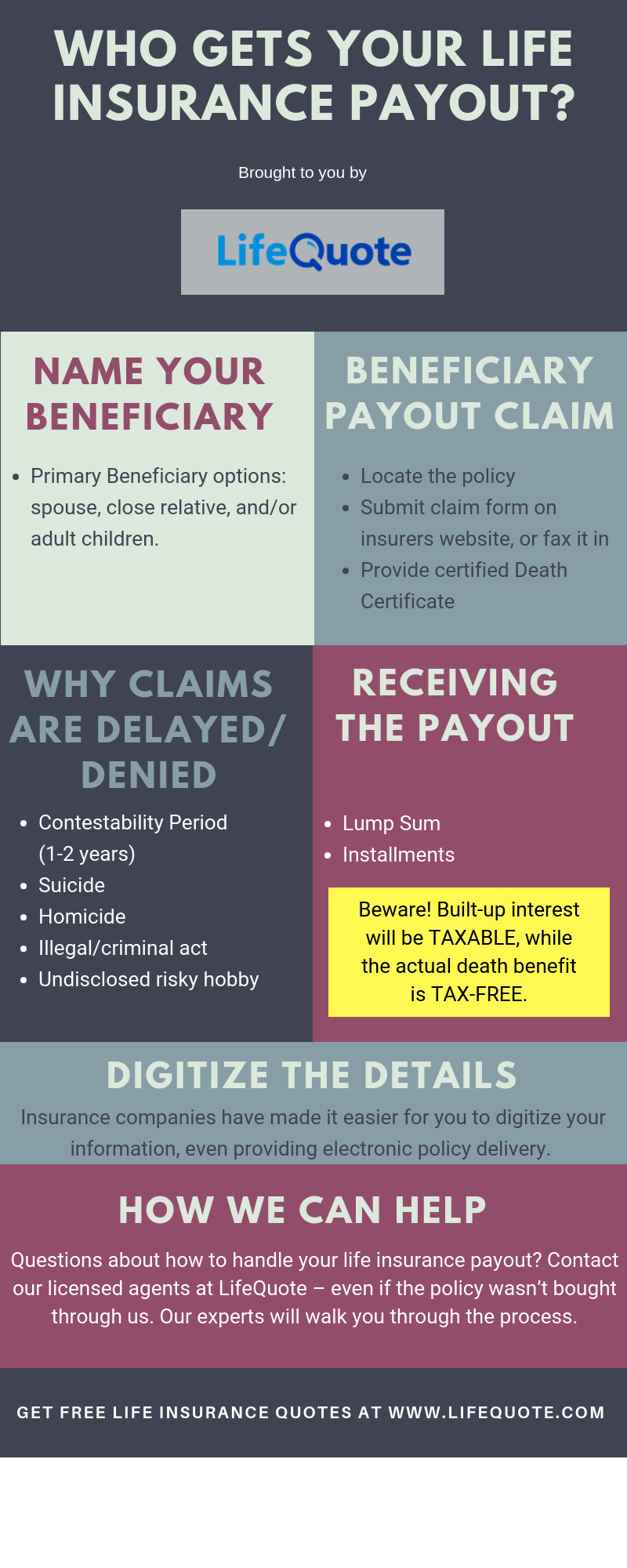

Who Gets Life Insurance Payout? Make Sure your Beneficiary Gets Paid

Understanding the working of life insurance payout is complicated and sometimes can become a daunting experience for your family when they are not able to get ahold of it. This article will help you understand most of the process so you can make sure your beneficiaries get paid on time, with no extra effort.

Understanding Life Insurance Payout:

It is one of the most common areas of concern and inquiries we get from clients who have purchased a life insurance policy; how to make sure their beneficiary gets paid after the death of the policyholder.

Conversely, when the insured dies, we often hear from relatives seeking answers on how to receive the insurance benefit. Sometimes they don’t even know if they were the beneficiaries, and most often, it becomes impossible to locate the actual policy, so they have to reach out to the insurance carrier and piece together a complicated puzzle. All of this should weigh on the mind of the insured person when they purchase a policy because after all, the reason you buy the coverage in the first place is to provide financial security and peace of mind for your loved ones.

We take this matter very seriously because the emotional loss is difficult enough, so our goal is to help you fully understand how life insurance works and to make sure your beneficiaries receive the life insurance payout you intended for them.

>> Read: How to Choose Life Insurance Beneficiary?

Name Your Beneficiary

The first step in the process is designating a beneficiary, along with filling out financial and health questionnaires, and a possible medical exam, as part of the traditional life insurance application and approval process. But choosing the person(s) who will get the life insurance payout upon your death is perhaps the most important step of all.

- The first thing to consider is who would suffer some type of financial loss if you (the insured) were to die. That is called “Insurable Interest.” The selection of “Primary Beneficiary” should be made with that in mind. The obvious choices are a spouse, partner, close relative, and children. Naming minor children as beneficiaries is not recommended; otherwise, it may up to a probate court to appoint a legal guardian to distribute the child’s payout.

- You don’t have to choose only one person; you can select several beneficiaries to divide the life insurance payout, designating the percentage of the portion they will receive. For instance, 50% to the spouse, and 25% to each of your two children.

- Besides the primary beneficiary, you also choose a secondary one, a/k/a “Contingent Beneficiary” to receive the proceeds if the primary were to die before you do.

- Updating your beneficiary choices is critical, especially during life stages such as a new marriage, divorce, or the addition of a child. Forgetting to replace an ex after divorce could leave the former Mr. or Mrs. with a big payout after your death. Changing beneficiaries is as simple as filling out an online form that you download from your insurance carrier’s website.

- Naming your estate as the beneficiary is an option but a hefty insurance payout can increase your estate taxes. Your attorney or accountant can best advise you about this.

- The same goes for naming a trust as the beneficiary, so consult a tax specialist about this option also.

How a Beneficiary Makes a Life Insurance Payout Claim?

Insurance death benefit payouts don’t just happen automatically when the insured dies. The carrier typically requires that beneficiaries produce proof of death and file a formal insurance claim to receive payment. The good news is that it is not a complicated process, but it does take a little legwork to piece it all together.

- Start by Finding the Insurance Policy. Things will go much quicker if you can produce the actual policy, the policy number, beneficiary information, etc. Locating that original insurance contract is a common problem because people don’t always remember where they put a policy they bought 20-years ago.

- That is why you should keep your policy in a secure place or share a copy with your beneficiary. Another copy should be provided to an attorney who drew up your Last Will and Testament.

- The carrier will do their part to help beneficiaries locate policy numbers and more and help them get paid, but they are concerned about insurance fraud and will require documentation. This process alone might hold up your life insurance payout.

- Many companies now let you submit the Claim Form online on the company website. For those carriers who don’t, you will likely have to fax in the required paperwork.

- A certified copy of the insured’s Death Certificate will be required, which the deceased’s funeral director can provide.

- The whole process to receive the life insurance payout could take from weeks to months from the date of the claim.

Unfortunately, life insurance death benefits remain unclaimed because sometimes the beneficiaries of the policy are unaware that they were even named in a policy. That is a worst-case scenario because state insurance regulators are constantly improving guidelines and practices of large insurance companies to make them aggressively identify policies that are due for death benefit payouts.

Reasons Why a Claim Could be Delayed or Denied

The key term to remember is “Contestability Period.”This period, which varies from state to state, runs from one to two years after the insured buys the life insurance policy. The reason this rule is in place is to prevent fraud.

The infamous Suicide Clause. That is one of the reasons a claim can be denied… if the policyholder commits suicide within one to two years from the enforce date of the policy. Again, it depends on the state of residence.

Death by homicide, or if the insured dies while committing an illegal or criminal act, are other reasons a carrier can contest or deny a payout to a beneficiary.

Even a frequent risky hobby (skydiving, auto racing) that caused the death of the insured, which wasn’t disclosed in the original insurance application, is cause for denial or at least investigation.

Beneficiaries Have Control Over How To Receive Life Insurance Payouts

Do you want all the money now… in a lump sum… or in increments over your lifetime? Think of how it works when people win the state lottery; they can choose to get that big, fat check immediately, or space it out for the rest of their lives. It works in much the same way with a life insurance payout.

- Option #1 is the Lump Sum payout, paying the beneficiary the entire face amount of the policy up front. It’s the most popular choice because the cash can help them pay off a mortgage, and other big-ticket items immediately, and eliminate debt from day one. They can invest the unused money any way they want—- to provide needed long-term income, or bank it to pay off a child’s college tuition someday.

- Receiving the payout in Installments. This works by essentially letting the insurance carrier act like a bank for you, where they hold your money and pay you a little at a time. They will pay you interest on the cash that builds up over time. But…. that interest is considered taxable income, while the actual death benefit from the policy is tax-free to the beneficiary.

Digitize The Details

You have gone through a lot of trouble to shop for the right insurance policy and to make a conscious decision to invest in your family’s long-term future. The last thing you want is to let sloppy organization get in the way of providing the financial legacy for which you want to be remembered. Take charge of your life and get your financial house in order.

The insurance companies have made it easier for you to digitize your information, even providing electronic policy delivery, so you don’t have to be bogged down with old-school mounds of paperwork.

Take advantage of these 21st-century tools that will help you keep this valuable information forever. And share the news with the people who will benefit from your generosity by emailing them a copy of the policy information, and telling them that you are giving them a gift that could someday change their life.

If you have any questions about how to handle your life insurance payout, get in touch with our agents and advisors at LifeQuote – even if the policy you ask about wasn’t bought with us. Our experts will answer all your queries and walk you through the process.