- Speak to a licensed sales agent!

- (800) 521-7873

Term vs. Whole Life Insurance: Which One to Choose?

Should You Buy Term Life or Whole Life Insurance?

What should you choose from the two most popular variations of life insurance, Term life or Whole life insurance? It all depends on your unique financial situation and the length of time you need coverage. Let’s discuss this in detail making your decision-making process easier.

Life insurance is no fun topic, and it’s definitely not a process anyone enjoys. However, like death and taxes, it’s an important part of life and critical element of sound financial planning. Having some kind of life insurance in your life gives you peace of mind and shows your intimacy and care for your loved ones. While shopping for life insurance can be intimidating and complex however proper research and understanding can make things easier.

Term Life or Whole Life Insurance?

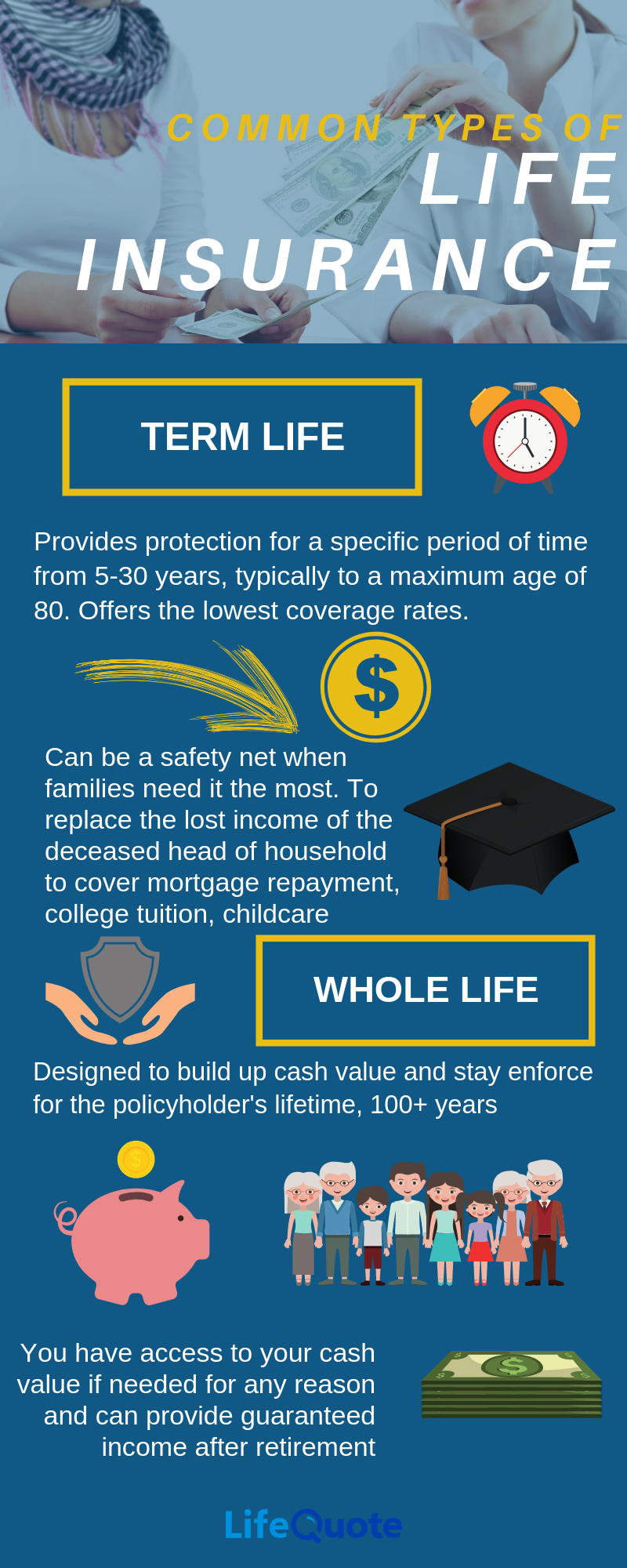

While the basic idea of providing financial assistance in the event of your death is the same, there are some big differences between the costs and benefits of each kind of insurance policy. Here is a rundown of both term life and whole life insurance so that you can make an informed decision for you and your family:

Term Life Insurance is Simple and Less Expensive:

Term life is the easiest and most affordable way to protect your loved ones if you die due to unforeseen circumstances. You can refer to term life insurance as a temporary coverage where you will be paying fixed premiums for a set number of years (i.e., term) and if your death occurs during that time, your beneficiaries will receive a lump sum of money as a death benefit.

The most attractive feature of Term life insurance is cost. You can purchase a large amount of coverage for relatively small premiums. For example, I ran a quote through LifeQuote’s website for a 34-year-old man, non-smoker and I got premium rates as low as $13.89 a month for a 20-year term life policy with $250,000 in coverage. That is so affordable, right? It’s like skipping a pizza night a month so my family can have a secure future. Paying $14 a month for peace of mind is not bad at all.

Now the most important question that almost everybody asks, especially if they are buying a 10-year or 20-year policy in their early 20’s or 30′, “What if I outlive my policy?” There’s nothing wrong in that. You are blessed with good health and age; nothing is more important than that right? The goal of the policy is to provide a protective shield to your loved ones in case something happens to you. If you outlive the policy, its purpose was served, and if you want to continue, you can renew it according to the rates you get at that time.

Whole Life Insurance Provides a Lifelong Protection and Builds Cash Value:

Whole life insurance is designed to provide protection for your entire life. It also accumulates cash value over time which means that the premiums you pay become part of the policy’s cash value. Another big advantage of whole life insurance is the ability to borrow cash against the policy. Since this type of insurance accrues cash value, you can also include it as a part of your retirement planning.

All these benefits may sound great, but everything comes with a price. Premiums are quite high in the first few years of a whole life policy as compared to term life policy. However, they do become more affordable with the passage of time.

Whole life may seem expensive at first, but it’s like an investment where your premiums grow and earn dividends as time goes by. Also, it is built on a tax-deferred basis, so any withdrawals you make within the value of premiums you have already paid will be tax-free, and any payouts made to beneficiaries will not be counted as taxable income. If you are looking for a permanent insurance solution, then no option is better than whole life insurance.

Which One to Choose?

Policy features of Term and Whole life insurance:

| Policy Feature | Term Life | Whole Life |

|---|---|---|

| Choice of Policy Length | * | |

| Death Benefit | * | * |

| Low Premiums | * | |

| Lifelong Protection | * | |

| Accumulates Cash Value | * |

Before choosing a life insurance policy, always analyze your financial situation and goals. Let’s have a look at some of the situations below:

- If you are in a risky profession and have dependents, then choosing a term life insurance seems economical.

- If you are looking for a protective umbrella that can cover your family while you work and invest your extra money in some prospective way then again term life insurance is your go-to policy. Paying low premiums gives you the chance to save up money for future and other business opportunities while keeping you stress-free at the same time.

- On the other hand, if you are looking for an insurance that doesn’t expire, and the idea of building cash equity is appealing to you then simply choosing whole life insurance could be the best option for you.

Whichever type of insurance you choose, make sure it gives you peace of mind and satisfies your families needs. If you are unsure and need assistance, give us a call. Our professional insurance agents will make sure they answer all your queries and provide the best possible solutions. Let us help you build a secure future for your family.

I hope you found our comparison article on “Term life and Whole life insurance ” useful and informative. Please like and share to spread this valuable information to others.